About Us

The Urner Barry Story

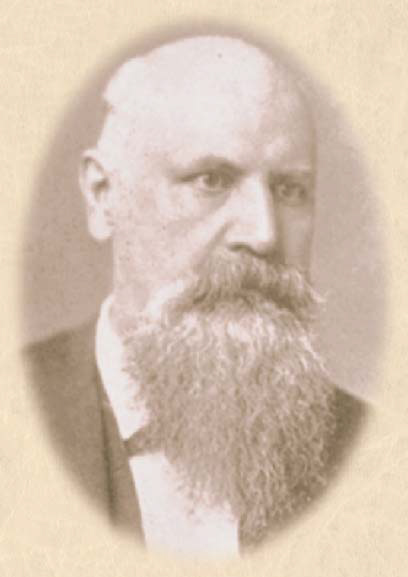

Our roots date back to 1858 when founder Benjamin Urner, a successful printer in New York City, was being regularly commissioned to prepare various price circulars for consigned agriculture goods by merchants as they flooded into the city from around the world.

Mr. Urner noted discrepancies within the circulars and realized how difficult it must be for customers to assimilate market appraisals which were often in variance with each other. This led him to the idea of publishing a single, objective market report which later would be universally known as Urner Barry’s Price-Current, the founding block of our premiere platform, COMTELL.

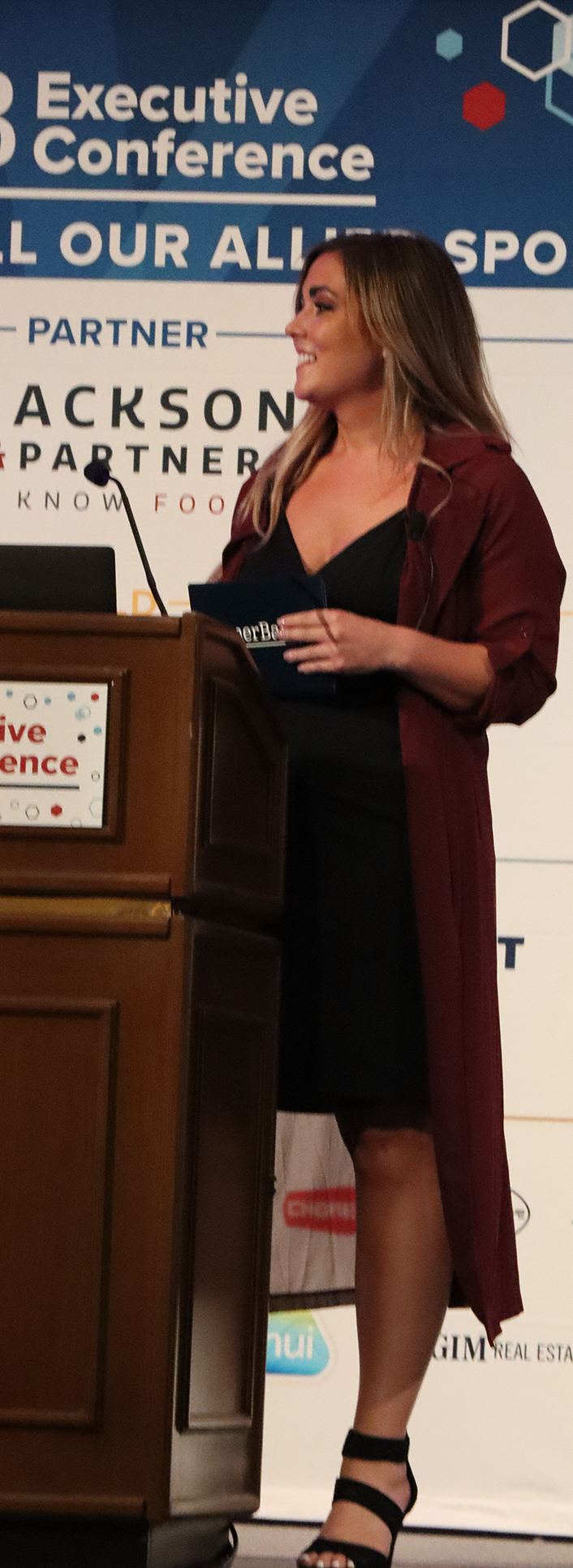

How We Serve Our Customers

Our team of market reporters, analysts, data scientists and global correspondents are dedicated to fulfilling the Urner Barry mission of providing timely, accurate and unbiased market information directly to our subscribers on a daily basis. We provide tailored solutions, allowing users to negotiate with confidence, while minimizing risk and uncertainty to uncover the next growth opportunities.

Our Reporting Guidelines

Each trading day, both solicited and unsolicited information is gathered by our highly experienced market reporting staff. Industry participants on both sides of the sale are contacted throughout the day to ensure that our reporters are kept current on the trading levels as well as the market's potential direction and movement. All trading participants and their reported information are kept strictly confidential. Data collected includes, but is not limited to, what products have been traded, what products are being offered and by whom, the price at which product is being offered, what levels are being bid and by whom, shipping dates, and all other pertinent information which will aid in the finalization of our quotations. Sales must be verifiable, and the product must be of standard cut, weight, grade, packaging and/or trim and must not be distressed or offered or bought under distressed conditions.

The final quotes that our reporters arrive at each day are based only on sales, bids, or offers for cash terms. During a period of light demand or weak markets, we must consider what one can expect to pay for product based on supplier asking prices or, when the market is active or firm, we must look at what buyers are willing to pay based on bids despite the fact that short supplies have kept sales quite thin. The quote does not represent every transaction recorded, nor does it represent the high or the low, but rather the bulk of sale or the rule for that commodity, not the exception.